service risk survey

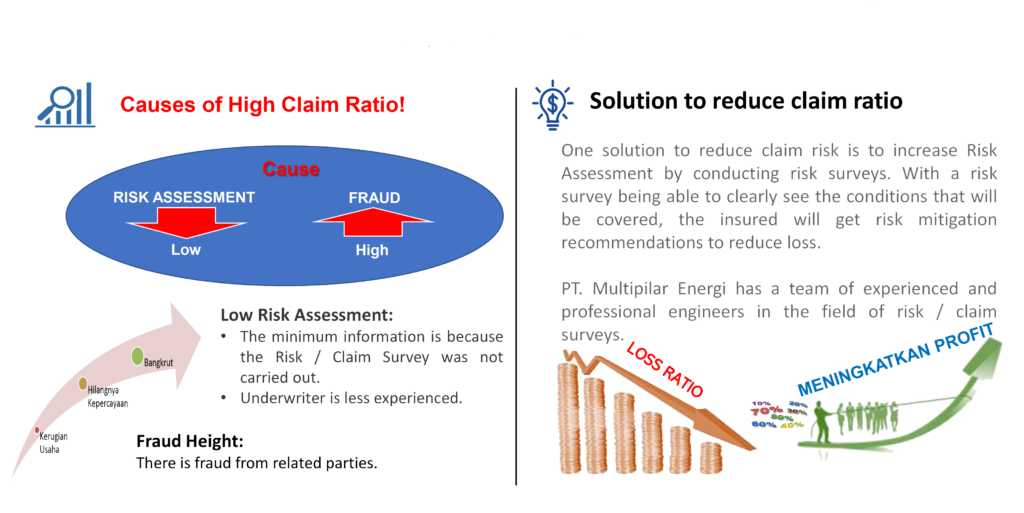

Why is a Risk Survey Needed?

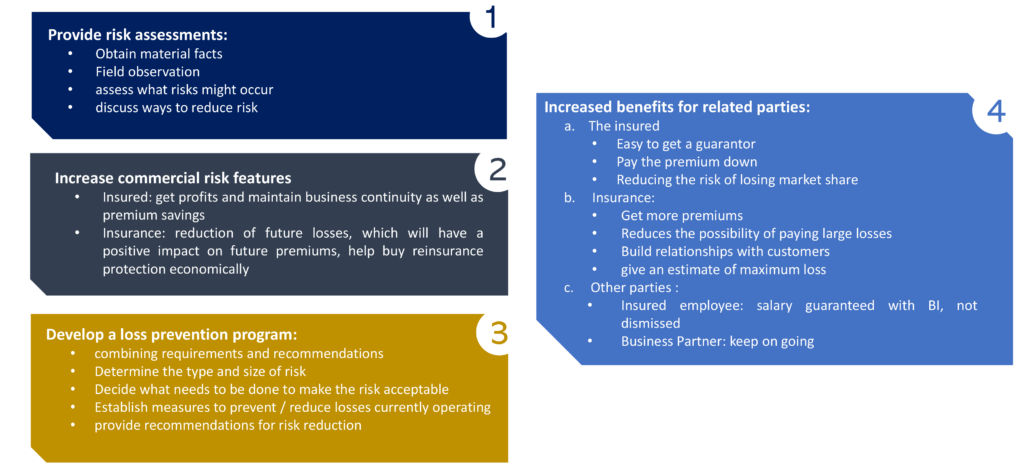

Purpose of the Survey

The Role of Surveyors in Risk Control and Mitigation

❖ Provide a description of the business and processes carried out at the place to be insured.

❖ Provide details of each dangerous process.

❖ Explain the construction and all elements related to the spread of fire

❖ Assess Expected Maximum Loss (EML) on buildings, contents and stock by insured hazards.

❖ Explain an overview of fire detection and equipment to put out, intruder alarm and comment on their

effectiveness.

❖ Investigate the actions taken following previous losses.

❖ Provide management standard comments relating to insured hazards.

❖ Provide a risk opinion, usually in relation to other similar risks.

❖ Where business interruption insurance is involved, information must be provided to support estimating EML,

This will include a business description and figure.

❖ Surveyors need to provide advice on whether risks are acceptable or if they can be made accepted with

improvements. Surveyors need to consider important improvements and write recommendations for

implementation.

❖ the surveyor can test the effective work of fire and theft equipment, examine drawings and specifications for

the equipment.

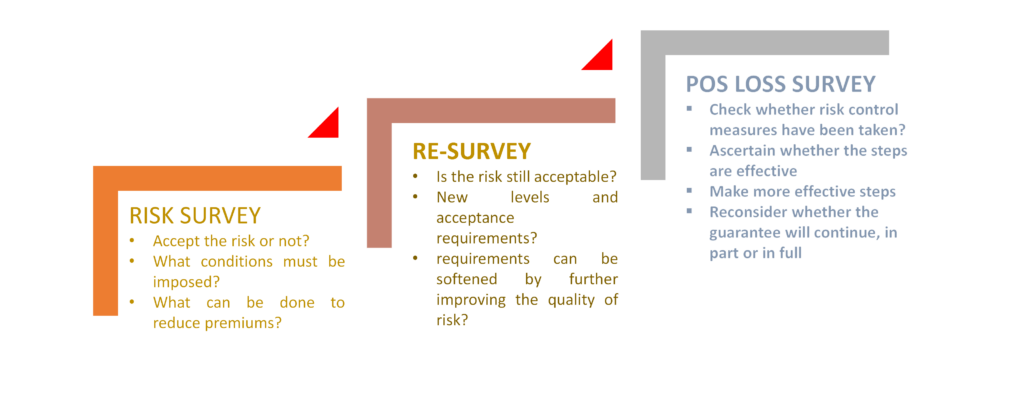

Use of Risk Survey Reports for Insurance

RISK SURVEY REPORT - PROPERTY (Report Summary)

1. Executive Summary

2. Description of buildings, machinery and maintenance.

3. Occupancy (Process, material and storage arrangements, sequential, bottle neck, inter-dependency,

independent process flow).

4. Utilities (water / electricity / gas network)

5. Contractor management, hot work permit

6. Occupational hazard, Natural hazard, Environmental hazard

7. Fire / explosion protection Active and Passive, emergency response team

8. Waste management and Housekeeping.

9. Maintenance & Inspection

10. HSE and Safety Studies

11. Security

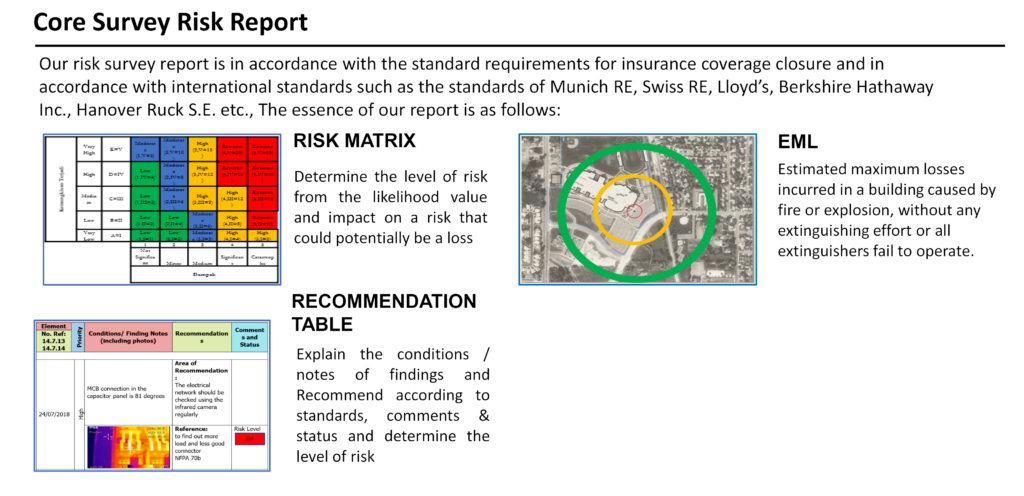

12. EML

13. Claim experience

14. Risk Improvement Recommendation

15. And others

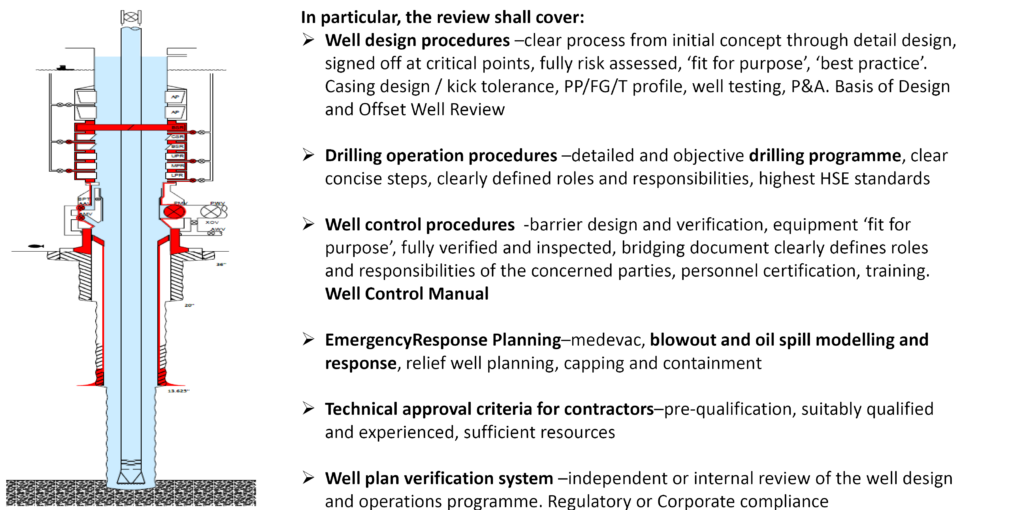

Oil and Gas - Drilling Risk Survey

Site Survey and Investigation service is a survey process which is to ensure that during the drilling process the risks that might occur can be avoided and minimized, including a number of geohazards, environmental risks, and artificial seafloor hazards will be identified during the survey, with recommended mitigation measures

Our risk engineers evaluate and fully understand the design of the rig

drilling process and contract work, identify risk exposures, and improve loss control for mutual benefit of the Insured and the Insurer (stakeholders).

Need to know in the drilling process there is a possibility of blow out

(pressure that cannot be controlled, directly to the surface), so there must be pressure control from the ground.

Our risk engineers must investigate the procedures or planning that will be carried out in the event of a Kick or Explosion during drilling operations and Contingency planning in the event of environmental pollution such as an oil spill team,Risks that occur near the surface during the drilling process, Can be an explosion, fire, shallow gas, ground water pollution and so forth. and Risks that can occur during drilling in rock formations. The usual risks are Rig subsidence, Gumbo and bit balling, wellbore stability, slow Rate of Penetration, stuck drilling pipes, shallow gas and H2S, Loss Circulation (loss of mud that is circulated into rock formations), Kick and Blow Out (pressure release from formation), downhole equipment problems, stuck pipes and other risks.

The survey report presented detailed risk summary along with the main basic details of the well portfolio such as: reservoir characteristics, measured depth, formation pressure, well types, locations etc. Including detail of :

• Evidence of an effective well integrity management system that is effective and clearly followed by the operator.

• Details of the Well Integrity Guarantee include condition monitoring, routine inspection and maintenance and well testing, preventer blowout (BOP), wellhead valves, downhole safety valves and related equipment.

• A technical assurance process that provides clarity on dispensation (eq. deviations from company standards / procedures), and strict change management processes.

• Annular management details including well annular monitoring and Maximum Allowable Annular Surface Pressure reassessment

Valuation / Appraisal

Insurance valuation requires a variety of skills and professional experience, such as:

❖ Appreciation of costs for construction or supply of assets of similar size and utility.

❖ Appreciation of the demand and supply of building materials and labor, professional services and

planning and building approval processes that determine the time period for rebuilding.

❖ Appreciation of the costs of installation and commissioning as well as the time frame for factories

and insurance appraisal machines.

❖ The provisions of a planning scheme that can influence whether a building can be rebuilt in its

current form.

❖ Inheritance issues.

❖ General insurance policy provisions (including special differences between returns and

compensation, inclusions and exclusions, joint insurance and average conditions).

❖ Inflation in building costs.

❖ Market rent values (for loss of rent or allowance for alternative accommodation).

❖ The size and level of all improvements including building structures and additional improvements.

PT Multipilar Energi serves primarily to focus on insurance valuation for the purpose of determining

the insured amount, a broad understanding of valuation of losses after loss or damage is very

helpful in handling claims.

Our Valuation services are usually needed for one of the reasons:

❖ The value of assets to be replaced in the event of a total loss

❖ To determine the sum to be paid following loss or damage as a result of an insured peril.

The role of PT Multipilar Energi in Valuation Practices depending on the scope of work agreed with

the client is to give advice:

❖ Estimated recovery costs and / or estimated value of compensation from assets for insurance

purposes at the valuation date.

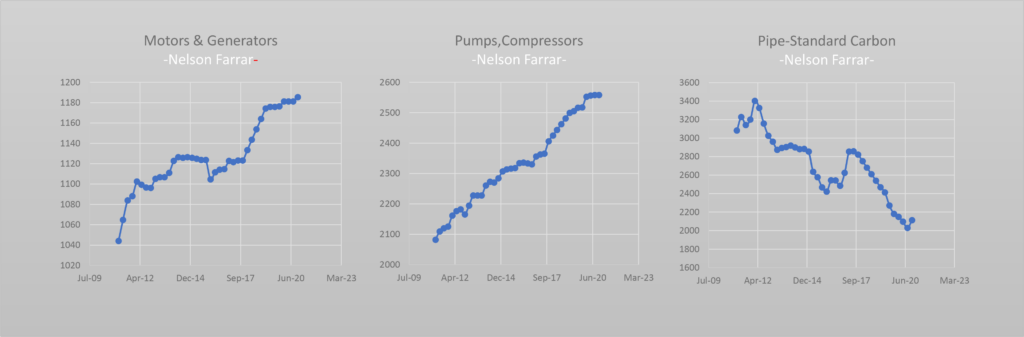

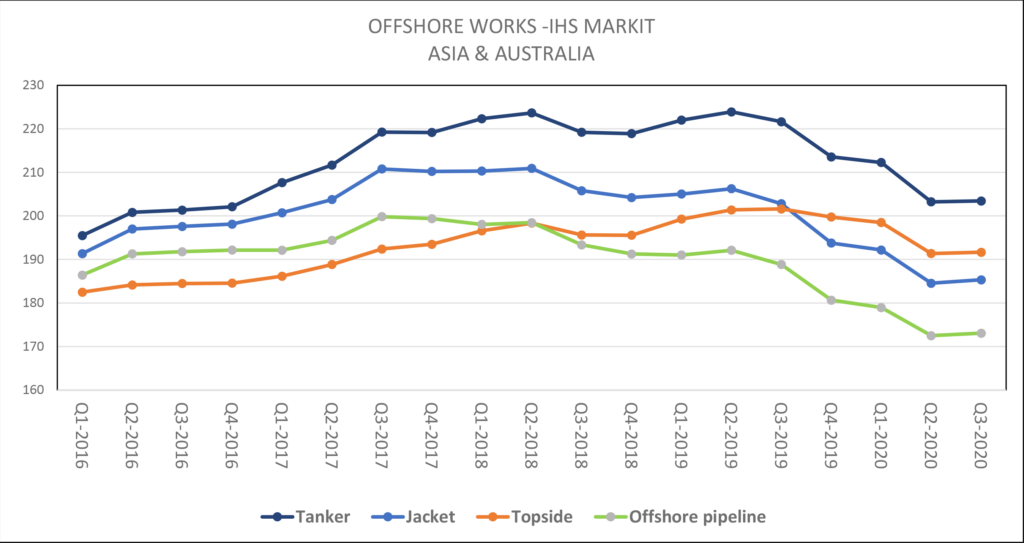

This follow the result by risk survey team to make Client understanding what risk survey has been valued in grey area as EML (Estimated Maximum Lost) or as using our value as basic for decide where insurance scope will be implemented by Client. Surveying valuation are used for assets of complex operations such as onshore installations, refineries to manufacturing facilities as a key essential for any risk management program. To assist clients in asset calculation and analysis, PT. Multipilar Energi has developed a Comprehensive Cost Database Software, with various published and widely used indexes such as Marshal & Swift, Richardson Database (Process Plant Construction Cost), Nelson Farrar Index, IHS Markit Index, PPI Index and Chemical

Engineering Index. In the calculation and analysis of assets we do not only for the company’s financial accounting but can also assess assets for insurance purposes. PT Multipilar Energi has 10 years of experience and more than 20 years of experience in the Valuer Team for assessment work in Indonesia.

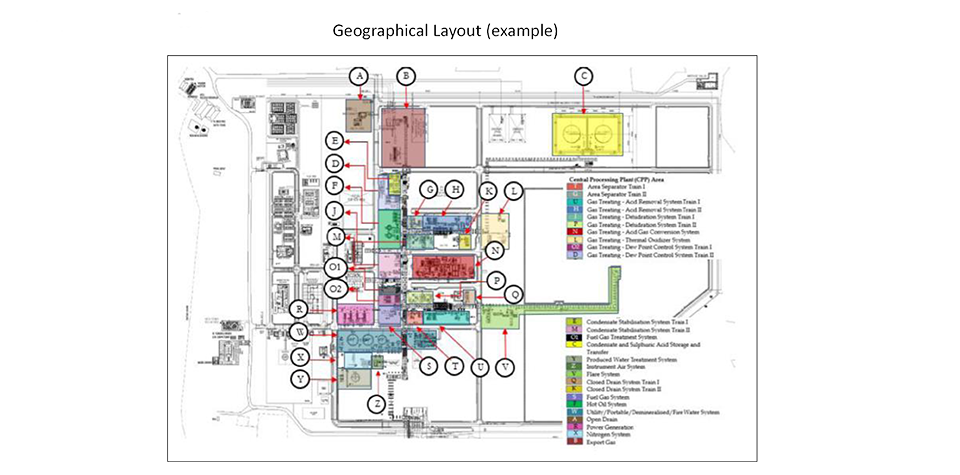

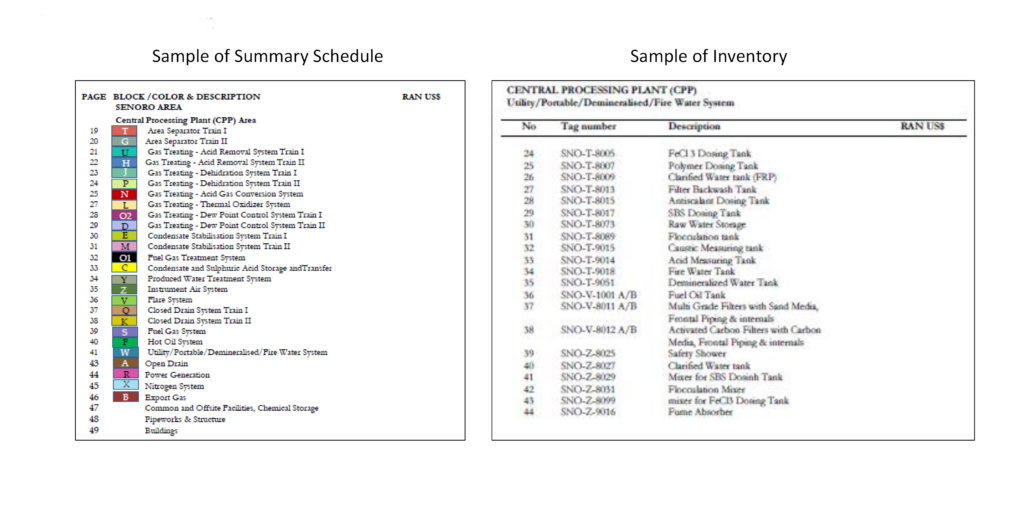

There are 2 types of the reports that we usually perform, Normal Desktop/Survey Valuation and Individual Valuation. Most of our clients use the Normal Desktop/Survey Valuation Type. It provides a total value per unit within the limits of the battery or fence limit. But it is possible if there is a request for an individual type of Valuation report, which provides more detail per item or grouping values based on the client’s purposes. Normally the report provides data that we collect from the field and office for us to process and calculate based on international or local standard calculation methods depending on the construction standards of a facility used.

Valuation / Appraisal

Example of Index Used

Report Presentation